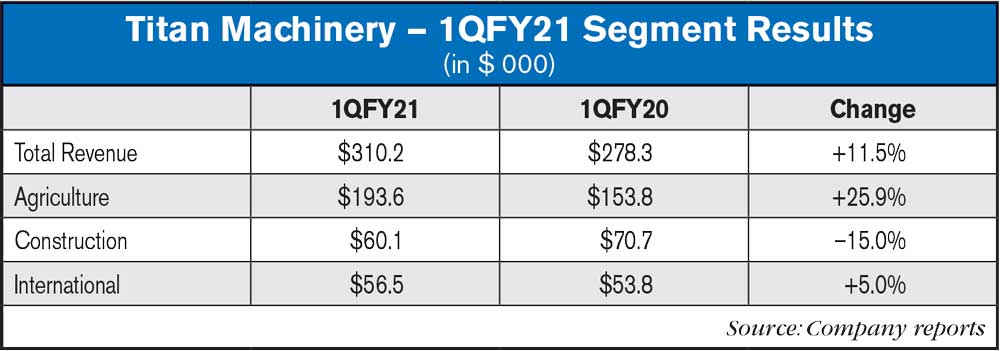

Titan Machinery Posts Big 1QFY21 Revenue Gains; Total Revenue Up 11.5%, Ag Rises 26%

Titan Machinery Inc. (Nasdaq: TITN) reported financial results for the fiscal first quarter ended April 30, 2020, which included first quarter revenues of $310.2 million compared to $278.3 million in the same period a year earlier.

David Meyer, Titan Machinery's chairman and chief executive officer, said, “We are pleased to report a strong first quarter performance during this uncertain environment, driven by our continued focus on customer service and sound management of our operating expenses.

Our Agriculture segment revenue increased 26% as equipment, parts and service all experienced solid double-digit growth. Our store operations teams have adjusted well to the new COVID-19 safety protocols that we put in place in March and have continued their uninterrupted service to customers during the important spring planting and the start of the construction season.

While we are pleased with the overall performance of our Agriculture segment in fiscal first quarter, this solid top and bottom line performance was slightly offset by the relative underperformance of our Construction and International results which were impacted more by the pandemic,” said Meyer.

Fiscal 2021 First Quarter Results

Consolidated Results

For the first quarter of fiscal 2021, equipment sales were $218.5 million compared to $194 million in the first quarter last year. Parts sales were $56.6 million during the period compared to $51.9 million a year ago. Revenue generated from service was $25.6 million compared to $22.8 million in the first quarter last year. Revenue from rental and other was $9.5 million vs. $9.6 million for the same period last year.

Gross profit for the first quarter of fiscal 2021 was $58.4 million, compared to $53.9 million in the first quarter last year. Gross profit margin decreased 60 basis points to 18.8% vs. the comparable period last year. The decrease in gross profit margin was primarily due to lower equipment margins in the current quarter as compared to the first quarter of last year.

Operating expenses increased by $0.5 million to $53.1 million, or 17.1% of revenue, for the first quarter of fiscal 2021, compared to $52.6 million, or 18.9% of revenue, for the first quarter of last year. The Company was able to leverage relatively flat operating expenses over increased revenues compared to the prior year.

Segment Results

Agriculture Segment — Revenue for the first quarter of fiscal 2021 was $193.6 million, compared to $153.8 million in the first quarter last year. The increase in revenue was driven by strength in equipment sales and supported by ongoing momentum in parts and service revenue. Pre-tax income for the first quarter of fiscal 2021 was $6.2 million, compared to $1.9 million of pre-tax income in the same period a year earlier.

Construction Segment — Revenue for the first quarter of fiscal 2021 was $60.1 million, compared to $70.7 million in the first quarter last year. The decrease in revenue was primarily the result of lower equipment demand due to macroeconomic challenges and uncertainty, which also impacted parts and service to a lesser extent. Pre-tax loss for the first quarter of fiscal 2021 was $2.9 million, compared to a pre-tax loss of $2.2 million in the first quarter last year. Adjusted pre-tax loss for the first quarter of fiscal 2021 was $2.7 million vs. $2.1 million in the first quarter last year.

International Segment — Revenue for the first quarter of fiscal 2021 was $56.5 million, compared to $53.8 million in the first quarter last year. Pre-tax loss for the first quarter of fiscal 2021 was $0.3 million, compared to income of $0.2 million in the first quarter last year. Adjusted pre-tax income for the first quarter of fiscal 2021 was $0.5 million, compared to $0.2 million in the first quarter last year. The adjusted amounts exclude a Ukraine remeasurement loss of $0.8 million in the current year, resulting from the devaluation of the Ukrainian hryvnia, compared to a small remeasurement gain in the prior year.

New Amended & Restated Credit Agreement

In April 2020, Titan Machinery entered into a new 5 year Amended and Restated Credit Agreement, maturing April 2025 replacing the previous credit facility that was scheduled to expire in October 2020.

The new Amended and Restated Credit Agreement provides for an aggregate $250 million financing commitment by the lenders, consisting of an aggregate floorplan financing commitment of $185 million and an aggregate working capital commitment of $65 million. The floorplan facility features improved flexibility with higher advances available against new and used inventory, and the working capital facility provides for a greater breadth of assets that can be utilized in its borrowing base, in addition to higher advance rates compared to the prior facility.

The Amended and Restated Credit Agreement does not obligate the company to maintain financial covenants, except in certain circumstances, with terms that are similar to those in the previous credit facility but favorably impacted by the increased advanced rates, which adds to the company's excess availability amount.

The interest rate for loans under the credit facility will be equal to LIBOR (subject to a floor of 0.5%) plus an applicable margin based on the company's excess availability. The initial applicable margin is 1.5%, resulting in an effective initial interest rate of 2.49%.

Closing of HorizonWest Acquisition

On May 4, 2020, the company closed on its acquisition of HorizonWest Inc., which consists of a three store Case IH agriculture dealership complex in Scottsbluff and Sidney, Neb. and Torrington, Wy.. In its most recent fiscal year, HorizonWest generated revenue of approximately $26 million. The total purchase price was $6.9 million, which does not include $2.7 million of associated inventory that the company concurrently purchased from CNH Industrial under standard terms. Titan Machinery expects the acquisition to be accretive to earnings in the first year of ownership.

Meyer added, "Our team continues to carefully manage through this disruptive environment and our solid first fiscal quarter validates the many strengths of our overall business. We improved our strong financial position during the quarter and are very pleased with our new credit agreement that provides additional flexibility and access to capital. We continue to maintain our focus on long term organic and acquired growth initiatives. We are grateful to our employees who are meeting the COVID-19 challenges every day as we have adapted our operations to focus on the safety of our employees while meeting the needs of our customers."